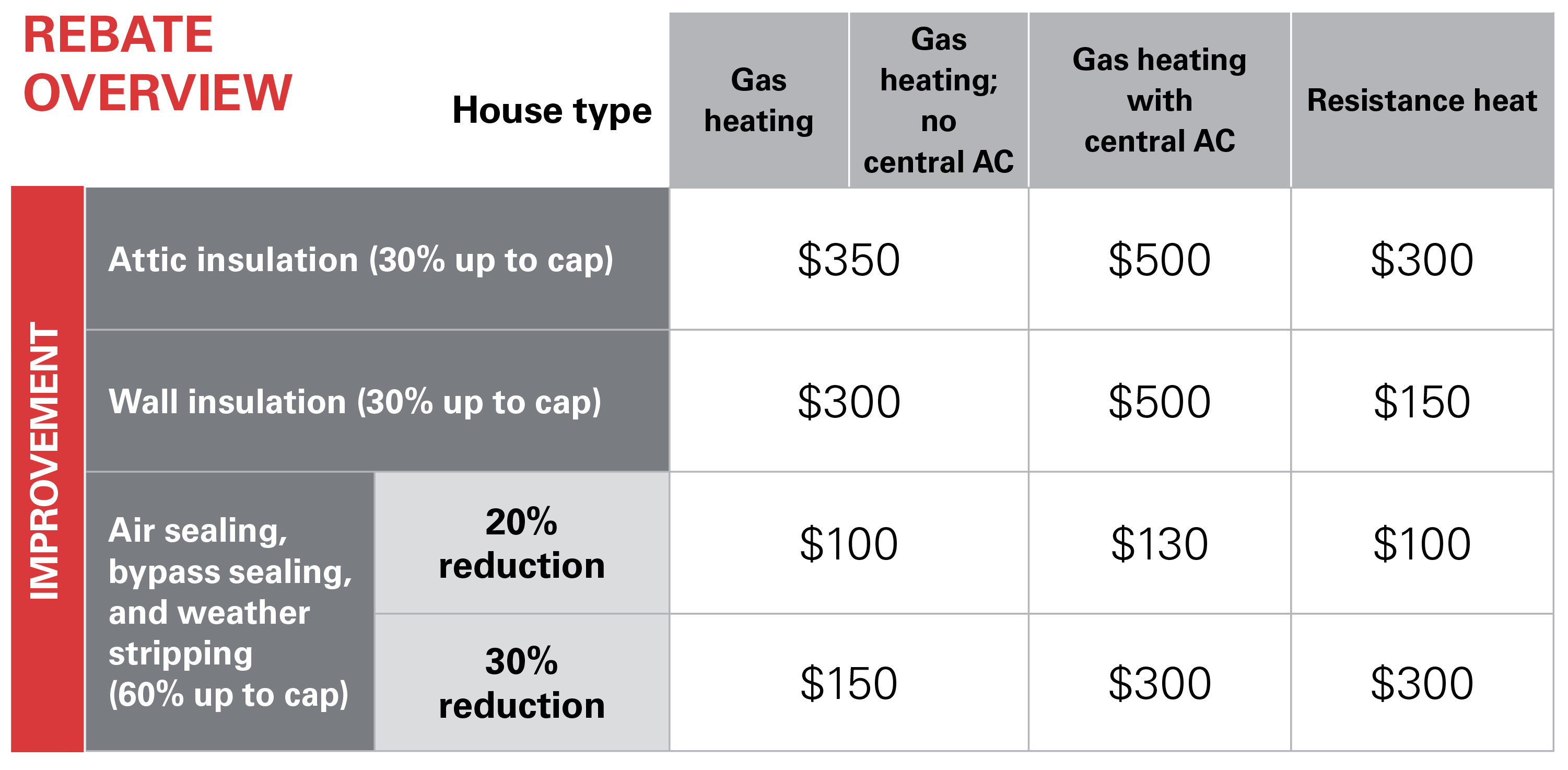

With the home reno rebate from enbridge gas or the enbridge home energy conservation program in partnership with the government of ontario and save on energy you could be eligible for renovation rebates plus additional electric appliance rebates.

Government rebate for attic insulation.

You could deduct 100 of energy related property costs but this portion of the credit had a maximum lifetime limit of 500 you couldn t claim 500 per year.

This program offered by newfoundland labrador hydro and newfoundland power gives residents a rebate of 75 of the cost of insulation for your basement ceiling or walls up to 1 000 and a rebate of 50 of the cost of insulation for your attic up to 1 000.

Saving homeowners on insulation dominion energy rebates questar rebates and rocky mountain power insulation rebates.

The federal government has reinstated the federal 25c tax credit program until december 31 2020.

Homeowners can be eligible for a tax credit of up to 500 or 10 of qualified energy efficiency improvements such as insulation.

Financing energy efficiency improvements financing insulation costs is another approach if you want to avoid any immediate out of pocket expenses.

The audit costs reimbursement is now 550.

Get up to 5 000 ontario government grants in ontario including insulation rebates up to 4 190 in toronto ottawa hamilton london ontario kitchener.

The boiler rebate has increased from 750 to 1000.

Get up to 5 000 government of canada grants in ontario including insulation rebates up to 4 190 in.

Rebates up to 4 190 for attic wall basement insulation and more.

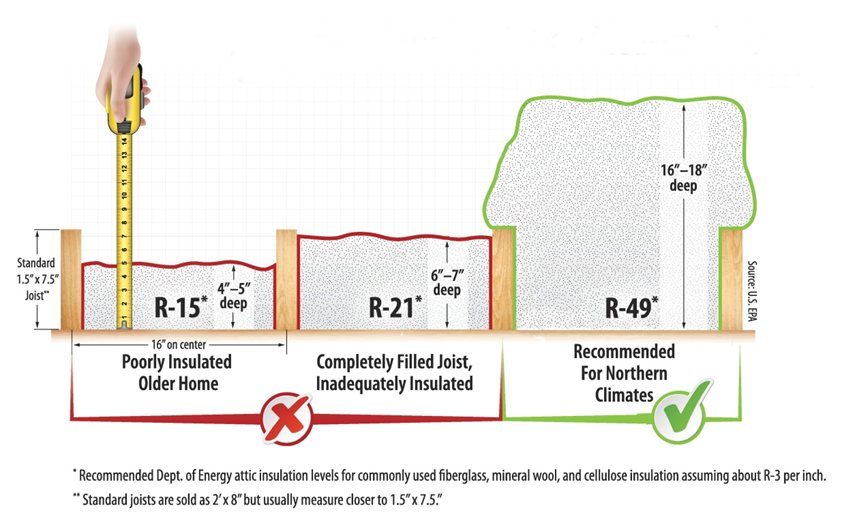

10 of the cost up to 500 requirements typical bulk insulation products can qualify such as batts rolls blow in fibers rigid boards expanding spray and pour in place.

500 rebate for increasing attic insulation to at least r60 from r35 or less.

Enbridge gas will be increasing its insulation incentives starting january 1st 2020.

The credit for home insulation exterior doors certain roofing materials and exterior windows and skylights was just 10 of the cost.

Learn more about the tax credit.

Section 25c tax credit for qualified energy efficiency improvements offers a 10 tax credit worth up to 500 for homeowners for qualified energy efficiency upgrades such as building insulation.

Insulation this tax credit has expired adding adequate insulation is one of the most cost effective home improvements that you can do.

It only requires one additional upgrade.